Valuation of Environmental Management Standard ISO 14001: Evidence from an Emerging Market

Abstract

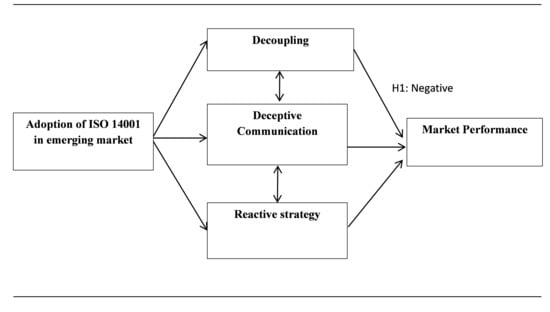

:1. Introduction

2. Prior Literature

3. Data Sources and Methodology

3.1. Sources of Data

3.2. Methodology

- Well-Defined Event: On the top, the initial task of employing event methodology is to define the well-defined specific event of interest and to isolate the time period for which the financial outcome proxies (Retrun on sales, Return on assets, Tobin’s Q, etc.) in the particular well-defined event will be investigated, known as the “event window”. This study defined ISO 14001 certification as the event of interest and defined the event period as the year in which firms got certified with ISO 14001. The abnormal performance in the Tobin’s Q is investigated over a long post-event window of four years.

- Selection of Control Firms: The primary objective of the event study is to isolate the short-term impact of a specified event as the underpinning theory, efficient market hypothesis theory (Fama 1991), emphasizes on short-term performance. Therefore, the use of event study to measure long-term performances might be biased. Particularly, there are two issues associated with event study methodology while evaluating long-term performance (Hendricks and Singhal 2005). The first problem is to find the factors that are required to be controlled while evaluating the long-term analysis. Prior researches identified previous performance and size of the firm as important factors that affect a company’s performance (Carhart 1997; Fama and French 1996). Following prior literature (De Jong et al. 2014; Candido et al. 2016; Corbett et al. 2005), we used ROA and total assets as control variables. The second problem associated with event study methodology is the cross-sectional dependency caused by overlapping time periods among the sample firms while evaluating long-term performance variables. Prior studies suggested one-to-one matching to overcome this issue (Lyon et al. 1999; Barber and Lyon 1997; De Jong et al. 2014). Therefore, this study also used one-to-one matching criteria, where each certified firm is matched with a non-certified one that has a close pre-event ROA, size, and industry (using two-digit SIC codes).

4. Analysis and Results

4.1. Main Results

4.2. Alternative Tests

5. Conclusions and Discussion

Author Contributions

Funding

Conflicts of Interest

References

- Aarts, Frank Martin, and Ed Vos. 2001. The impact of ISO registration on New Zealand firms’ performance: A financial perspective. The TQM Magazine 13: 180–91. [Google Scholar] [CrossRef]

- Aravind, Deepa, and Petra Christmann. 2011. Decoupling of standard implementation from certification: Does quality of ISO 14001 implementation affect facilities’ environmental performance? Business Ethics Quarterly 21: 73–102. [Google Scholar] [CrossRef]

- Barber, Brad M., and John D. Lyon. 1996. Detecting abnormal operating performance: The empirical power and specification of test statistics. Journal of Financial Economics 41: 359–99. [Google Scholar] [CrossRef]

- Barber, Brad M., and John D. Lyon. 1997. Detecting long-run abnormal stock returns: The empirical power and specification of test statistics. Journal of Financial Economics 43: 341–72. [Google Scholar] [CrossRef]

- Boiral, Olivier. 2003. ISO 9000: Outside the iron cage. Organization Science 14: 720–37. [Google Scholar] [CrossRef]

- Boiral, Olivier. 2007. Corporate greening through ISO 14001: A rational myth? Organization Science 18: 127–46. [Google Scholar] [CrossRef]

- Boiral, Olivier, and Jean Francois Henri. 2012. Modelling the impact of ISO 14001 on environmental performance: A comparative approach. Journal of Environmental Management 99: 84–97. [Google Scholar] [CrossRef] [Green Version]

- Boiral, Olivier, and Marie-Josee Roy. 2007. ISO 9000: Integration rationales and organizational impacts. International Journal of Operations and Production Management 27: 226–47. [Google Scholar] [CrossRef]

- Bowen, Frances, and J. Alberto Aragon-Correa. 2014. Greenwashing in Corporate Environmentalism Research and Practice: The Importance of What We Say and Do. Organization and Environment 27: 107–12. [Google Scholar] [CrossRef]

- Candido, Carlos JF., Luis MS. Coelho, and Ruben MT. Peixinho. 2016. The financial impact of a withdrawn ISO 9001 certificate. International Journal of Operations and Production Management 36: 23–41. [Google Scholar] [CrossRef] [Green Version]

- Cañón-de-Francia, Joaquín, and Concepción Garcés-Ayerbe. 2009. ISO 14001 environmental certification: A sign valued by the market? Environmental and Resource Economics 44: 245–62. [Google Scholar] [CrossRef]

- Carhart, Mark M. 1997. On persistence in mutual fund performance. The Journal of Finance 52: 57–82. [Google Scholar] [CrossRef]

- Castka, Pavel, and Daniel Prajogo. 2013. The effect of pressure from secondary stakeholders on the internalization of ISO 14001. Journal of Cleaner Production 47: 245–52. [Google Scholar] [CrossRef]

- Chen, Fang, Thomas Ngniatedema, and Suhong Li. 2018. A cross-country comparison of green initiatives, green performance and financial performance. Management Decision 56: 1008–32. [Google Scholar] [CrossRef]

- Christmann, Petra, and Glen Taylor. 2006. Firm self-regulation through international certifiable standards: Determinants of symbolic versus substantive implementation. Journal of International Business Studies 37: 863–78. [Google Scholar] [CrossRef]

- Corbett, Charles J., Maria J. Montes-Sancho, and David A. Kirsch. 2005. The financial impact of ISO 9000 certification in the United States: An empirical analysis. Management Science 51: 1046–59. [Google Scholar] [CrossRef]

- Curkovic, Sime, and Robert Sroufe. 2011. Using ISO 14001 to promote a sustainable supply chain strategy. Business Strategy and the Environment 20: 71–93. [Google Scholar] [CrossRef]

- Darnall, Niclole, and Daniel Edwards Jr. 2006. Predicting the cost of environmental management system adoption: The role of capabilities, resources and ownership structure. Strategic Management Journal 27: 301–20. [Google Scholar] [CrossRef]

- Dbouk, Wassim, Dawei Jin, Haizhi Wang, and Jianrong Wang. 2018. Corporate Social Responsibility and Rule 144A Debt Offerings: Empirical Evidence. International Journal of Financial Studies 6: 94. [Google Scholar] [CrossRef]

- De Jong, Pieter, Antony Paulraj, and Constantin Blome. 2014. The financial impact of ISO 14001 certification: top-line, bottom-line, or both? Journal of Business Ethics 119: 131–49. [Google Scholar] [CrossRef]

- Delmas, Magali A., and Vanessa Cuerel Burbano. 2011. The drivers of greenwashing. California Management Review 54: 64–87. [Google Scholar] [CrossRef]

- Delmas, Magali A., and Maria J. Montes-Sancho. 2010. Voluntary agreements to improve environmental quality: Symbolic and substantive cooperation. Strategic Management Journal 31: 575–601. [Google Scholar] [CrossRef]

- Delmas, Magali A., and Ivan Montiel. 2007. The Adoption of ISO 14001 within the Supply Chain: When Are Customer Pressures Effective? Oakland: The Regents of the University of California. [Google Scholar]

- Delmas, Magali A., and Michael W. Toffel. 2008. Organizational responses to environmental demands: Opening the black box. Strategic Management Journal 29: 1027–55. [Google Scholar] [CrossRef]

- Dixon-Fowler, Heather R., Daniel J. Slater, Jonathan L. Johnson, Alan E. Ellstrand, and Andrea M. Romi. 2013. Beyond “does it pay to be green?” A meta-analysis of moderators of the CEP–CFP relationship. Journal of Business Ethics 112: 353–66. [Google Scholar] [CrossRef]

- Docking, Diane Scott, and Richard J. Dowen. 1999. Market interpretation of ISO 9000 registration. Journal of Financial Research 22: 147–60. [Google Scholar] [CrossRef]

- Dowell, Glen, Stuart Hart, and Bernard Yeung. 2000. Do corporate global environmental standards create or destroy market value? Management Science 46: 1059–74. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1991. Efficient capital markets: II. The Journal of Finance 46: 1575–617. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1996. Multifactor explanations of asset pricing anomalies. The Journal of Finance 51: 55–84. [Google Scholar] [CrossRef]

- Fisher-Vanden, Karen, and Karin S. Thorburn. 2011. Voluntary corporate environmental initiatives and shareholder wealth. Journal of Environmental Economics and Management 62: 430–45. [Google Scholar] [CrossRef]

- Flammer, Caroline. 2013. Corporate social responsibility and shareholder reaction: The environmental awareness of investors. Academy of Management Journal 56: 758–81. [Google Scholar] [CrossRef]

- Gavronski, Iuri, Geroldo Ferrer, and Ely Laureano Paiva. 2008. ISO 14001 certification in Brazil: motivations and benefits. Journal of Cleaner Production 16: 87–94. [Google Scholar] [CrossRef] [Green Version]

- Globerman, Steven, and Daniel Shapiro. 2009. Economic and strategic considerations surrounding Chinese FDI in the United States. Asia Pacific Journal of Management 26: 163–83. [Google Scholar] [CrossRef]

- Hammond, Sue Annis, and John W. Slocum. 1996. The impact of prior firm financial performance on subsequent corporate reputation. Journal of Business Ethics 15: 159–65. [Google Scholar] [CrossRef]

- He, Wenlong, and Rui Shen. 2017. ISO 14001 Certification and Corporate Technological Innovation: Evidence from Chinese Firms. Journal of Business Ethics, 1–21. [Google Scholar] [CrossRef]

- He, Wenlong, Chong Liu, Jiangyong Lu, and Jing Cao. 2015. Impacts of ISO 14001 adoption on firm performance: Evidence from China. China Economic Review 32: 43–56. [Google Scholar] [CrossRef]

- Hendricks, Kevin B., and Vinod R. Singhal. 2005. An empirical analysis of the effect of supply chain disruptions on long-run stock price performance and equity risk of the firm. Production and Operations Management 14: 35–52. [Google Scholar] [CrossRef]

- Heras-Saizarbitoria, Inaki, and Olivier Boiral. 2013. ISO 9001 and ISO 14001: towards a research agenda on management system standards. International Journal of Management Reviews 15: 47–65. [Google Scholar] [CrossRef]

- Heras-Saizarbitoria, Inaki, Jose F. Molina-Azorín, and Gavin PM. Dick. 2011. ISO 14001 certification and financial performance: Selection-effect versus treatment-effect. Journal of Cleaner Production 19: 1–12. [Google Scholar] [CrossRef]

- Hong, Harrison, and Marcin Kacperczyk. 2009. The price of sin: The effects of social norms on markets. Journal of Financial Economics 93: 15–36. [Google Scholar] [CrossRef] [Green Version]

- Husted, Bryan W., Ivan Montiel, and Petra Christmann. 2016. Effects of local legitimacy on certification decisions to global and national CSR standards by multinational subsidiaries and domestic firms. Journal of International Business Studies 47: 382–97. [Google Scholar] [CrossRef]

- ISO. 2015. ISO 14001:2015. Environmental Management System: Requirements with Guidance for Use. Geneva: International Organization for Standardization. [Google Scholar]

- Jacobs, Brian W., Vinod R. Singhal, and Ravi Subramanian. 2010. An empirical investigation of environmental performance and the market value of the firm. Journal of Operations Management 28: 430–41. [Google Scholar] [CrossRef]

- King, Andrew A., and Michael J. Lenox. 2001. Does it really pay to be green? An empirical study of firm environmental and financial performance: An empirical study of firm environmental and financial performance. Journal of Industrial Ecology 5: 105–16. [Google Scholar] [CrossRef]

- Klassen, Robert D., and Curtis P. McLaughlin. 1996. The impact of environmental management on firm performance. Management Science 42: 1199–214. [Google Scholar] [CrossRef]

- Lee, Yao Chun, Jin Li Hu, and Jia Fu Ko. 2008. The effect of ISO certification on managerial efficiency and financial performance: An empirical study of manufacturing firms. International Journal of Management 25: 166. [Google Scholar]

- Lee, Sang M., Yonghwi Noh, Donghyun Choi, and Jin Sung Rha. 2017. Environmental policy performances for sustainable development: from the perspective of ISO 14001 Certification. Corporate Social Responsibility and Environmental Management 24: 108–20. [Google Scholar] [CrossRef]

- Lo, Chris KY., Andy CL. Yeung, and Tai Chiu Edwin Cheng. 2012. The impact of environmental management systems on financial performance in fashion and textiles industries. International Journal of Production Economics 135: 561–67. [Google Scholar] [CrossRef]

- Lyon, John D., Brad M. Barber, and Chih Ling Tsai. 1999. Improved methods for tests of long-run abnormal stock returns. The Journal of Finance 54: 165–201. [Google Scholar] [CrossRef]

- MacLean, Tammy L., and Michael Behnam. 2010. The dangers of decoupling: The relationship between compliance programs, legitimacy perceptions, and institutionalized misconduct. Academy of Management Journal 53: 1499–520. [Google Scholar] [CrossRef]

- MacLean, Tammy, Barrie E. Litzky, and D. Kip Holdernes. 2015. When organizations don’t walk their talk: A cross-level examination of how decoupling formal ethics programs affects organizational members. Journal of Business Ethics 128: 351–68. [Google Scholar] [CrossRef]

- Majeed, Sadia, Tariq Aziz, and Saba Saleem. 2015. The effect of corporate governance elements on corporate social responsibility (CSR) disclosure: An empirical evidence from listed companies at KSE Pakistan. International Journal of Financial Studies 3: 530–56. [Google Scholar] [CrossRef]

- Marquis, Christopher, Jianjun Zhang, and Yanhua Zhou. 2011. Regulatory uncertainty and corporate responses to environmental protection in China. California Management Review 54: 39–63. [Google Scholar] [CrossRef]

- Martín-de Castro, Gregorio, Javier Amores-Salvadó, and Jose E. Navas-López. 2016. Environmental management systems and firm performance: improving firm environmental policy through stakeholder engagement. Corporate Social Responsibility and Environmental Management 23: 243–56. [Google Scholar] [CrossRef]

- Mellahi, Kamel, Jedrzej George Frynas, Pei Sun, and Donald Siegel. 2016. A review of the nonmarket strategy literature: Toward a multi-theoretical integration. Journal of Management 42: 143–73. [Google Scholar] [CrossRef]

- Melnyk, Steven A., Robert P. Sroufe, and Roger Calantone. 2003. Assessing the impact of environmental management systems on corporate and environmental performance. Journal of Operations Management 21: 329–51. [Google Scholar] [CrossRef]

- Montiel, Ivan, Bryan W. Husted, and Petra Christmann. 2012. Using private management standard certification to reduce information asymmetries in corrupt environments. Strategic Management Journal 33: 1103–13. [Google Scholar] [CrossRef]

- Pacana, Andrzej, and Robert Ulewicz. 2017. Research of determinants motiving to implement the environmental management system. Polish Journal of Management Studies 16: 165–74. [Google Scholar] [CrossRef]

- Parida, Sitikantha, and Zhihong Wang. 2018. Financial Crisis and Corporate Social Responsible Mutual Fund Flows. International Journal of Financial Studies 6: 8. [Google Scholar] [CrossRef]

- Paulraj, Antony, and Pieter De Jong. 2011. The effect of ISO 14001 certification announcements on stock performance. International Journal of Operations and Production Management 31: 765–88. [Google Scholar] [CrossRef]

- Potoski, Matthew, and Aseem Prakash. 2005. Green clubs and voluntary governance: ISO 14001 and firms’ regulatory compliance. American Journal of Political Science 49: 235–48. [Google Scholar] [CrossRef]

- Russo, Michael V. 2009. Explaining the impact of ISO 14001 on emission performance: A dynamic capabilities perspective on process and learning. Business Strategy and the Environment 18: 307–19. [Google Scholar] [CrossRef]

- Suchman, C. Mark. 1995. Managing legitimacy: Strategic and institutional approaches. Academy of Management Review 20: 571–610. [Google Scholar] [CrossRef]

- von Zharen, Wyndylyn M. 2001. ISO 14001: Positioning Your Organization for Environmental Success. Rockville: Government Institutes Press. [Google Scholar]

- Wahba, Hayam. 2010. How do institutional shareholders manipulate corporate environmental strategy to protect their equity value? A study of the adoption of ISO 14001 by Egyptian firms. Business Strategy and the Environment 19: 495–511. [Google Scholar] [CrossRef]

- Yadav, Prayag Lal, Seung Hun Han, and Jee Jeung Rho. 2016. Impact of environmental performance on firm value for sustainable investment: Evidence from large US firms. Business Strategy and the Environment 25: 402–20. [Google Scholar] [CrossRef]

- Yee, Rachel W., Andy CL. Yeung, and TC. Edwin Cheng. 2010. An empirical study of employee loyalty, service quality and firm performance in the service industry. International Journal of Production Economics 124: 109–20. [Google Scholar] [CrossRef]

- Zajac, Edward J., and James D. Westphal. 2004. The social construction of market value: Institutionalization and learning perspectives on stock market reactions. American Sociological Review 69: 433–57. [Google Scholar] [CrossRef]

- Zhao, Jiangning. 2008. The effect of the ISO-14001 environmental management system on corporate financial performance. International Journal of Business Excellence 1: 210–30. [Google Scholar] [CrossRef]

- Zhong, Ninghua. 2015. Corporate governance of Chinese privatized firms: Evidence from a survey of non-listed enterprises. Journal of Comparative Economics 43: 1101–21. [Google Scholar] [CrossRef]

| Mean | Median | Standard Deviation | Maximum | Minimum | |

|---|---|---|---|---|---|

| Sample firms | |||||

| Total Assets | 6637.753 | 4012.324 | 7684.287 | 31,452.125 | 637.427 |

| Sales | 6845.763 | 3995.985 | 7985.958 | 44,348.223 | 898.64 |

| Return on Assets | 9.428 | 7.24 | 9.421 | 30.19 | −7.3 |

| Return on Sales | 12.528 | 9.989 | 14.62 | 62.78 | −9.217 |

| Tobin’s Q | 1.578 | 1.352 | 1.304 | 5.317 | 0.041 |

| Control firms | |||||

| Total Assets | 2784.646 | 1372.073 | 4394.864 | 29,876.567 | 359.526 |

| Sales | 1792.634 | 1385.156 | 18,925.846 | 12,856.245 | 387.519 |

| Return on Assets | 8.412 | 8.135 | 10.254 | 34.39 | −16.87 |

| Return on Sales | 8.658 | 7.556086 | 10.745 | 44.251 | −22.0945 |

| Tobin’s Q | 1.552 | 1.352 | 1.474 | 5.985 | 0.03 |

| Base Year | Final Year | Abnormal Performance (Mean) | Abnormal Performance (Median) | p-Value (WSR Test) | p-Value (t-Test) | p-Value (Sign Test) |

|---|---|---|---|---|---|---|

| 2010 | 2011 | 0.147 | 0.082 | 0.171 | 0.534 | 0.164 |

| 2011 | 2012 | 0.313 | 0.204 | 0.115 | 0.399 | 0.164 |

| 2012 | 2013 | −0.366 | −0.189 | 0.002 *** | 0.004 *** | 0.000 *** |

| 2013 | 2014 | −0.355 | −0.073 | 0.000 *** | 0.000 *** | 0.000 *** |

| 2014 | 2015 | −0.619 | −0.635 | 0.000 *** | 0.000 *** | 0.000 *** |

| 2015 | 2016 | −0.628 | −0.524 | 0.000 *** | 0.000 *** | 0.000 *** |

| 2011 | 2013 | −0.048 | −0.044 | 0.021 *** | 0.000 *** | 0.000 *** |

| 2011 | 2014 | −0.203 | −0.067 | 0.000 *** | 0.000 *** | 0.000 *** |

| 2011 | 2015 | −0.305 | −0.228 | 0.000 *** | 0.000 *** | 0.000 *** |

| 2011 | 2016 | −0.377 | −0.313 | 0.000 *** | 0.000 *** | 0.000 *** |

| Base Year | Final Year | Abnormal Performance (Mean) | Abnormal Performance (Median) | p-Value (WSR Test) | p-Value (t-Test) | p-Value (Sign Test) |

|---|---|---|---|---|---|---|

| 2010 | 2011 | 0.035 | −0.102 | 0.002 *** | 0.001 *** | 0.001 *** |

| 2011 | 2012 | 0.431 | 0.084 | 0.488 | 0.571 | 0.771 |

| 2012 | 2013 | −1.113 | −0.89 | 0.00 ** | 0.024 *** | 0.02 *** |

| 2013 | 2014 | −0.533 | −0.817 | 0.5006 | 0.6767 | 0.3621 |

| 2014 | 2015 | −0.521 | −0.558 | 0.08 ** | 0.192 | 0.301 |

| 2015 | 2016 | −0.464 | −0.39 | 0.07 ** | 0.312 | 0.01 *** |

| 2011 | 2013 | −0.448 | −0.423 | 0.02 *** | 0.04 *** | 0.02 *** |

| 2011 | 2014 | −0.478 | −0.536 | 0.00 *** | 0.00 *** | 0.00 *** |

| 2011 | 2015 | −0.489 | −0.574 | 0.00 *** | 0.00 *** | 0.00 *** |

| 2011 | 2016 | −0.484 | −0.542 | 0.00 *** | 0.00 *** | 0.00 *** |

| Base Year | Final Year | Abnormal Performance (Mean) | Abnormal Performance (Median) | p-Value (WSR Test) | p-Value (t-Test) | p-Value (Sign Test) |

|---|---|---|---|---|---|---|

| 2010 | 2011 | 0.03 | 0.02 | 0.807 | 0.728 | 0.754 |

| 2011 | 2012 | 1.64 | 1.01 | 0.1587 | 0.112 | 0.2145 |

| 2012 | 2013 | −2.59 | −2.56 | 0.076 ** | 0.042 *** | 0.435 |

| 2013 | 2014 | −2.34 | −2.24 | 0.00 *** | 0.00 *** | 0.00 *** |

| 2014 | 2015 | −2.24 | −2.16 | 0.00 *** | 0.00 *** | 0.00 *** |

| 2015 | 2016 | −2.33 | −2.35 | 0.00 *** | 0.00 *** | 0.00 *** |

| 2011 | 2013 | −0.035 | 0.04 | 0.712 | 0.812 | 0.952 |

| 2011 | 2014 | −0.501 | −0.646 | 0.004 *** | 0.002 *** | 0.000 *** |

| 2011 | 2015 | −0.667 | −0.852 | 0.000 *** | 0.000 *** | 0.000 *** |

| 2011 | 2016 | −0.714 | −0.104 | 0.000 *** | 0.000 *** | 0.000 *** |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Riaz, H.; Saeed, A.; Baloch, M.S.; Nasrullah; Khan, Z.A. Valuation of Environmental Management Standard ISO 14001: Evidence from an Emerging Market. J. Risk Financial Manag. 2019, 12, 21. https://doi.org/10.3390/jrfm12010021

Riaz H, Saeed A, Baloch MS, Nasrullah, Khan ZA. Valuation of Environmental Management Standard ISO 14001: Evidence from an Emerging Market. Journal of Risk and Financial Management. 2019; 12(1):21. https://doi.org/10.3390/jrfm12010021

Chicago/Turabian StyleRiaz, Hammad, Abubakr Saeed, Muhammad Saad Baloch, Nasrullah, and Zeeshan Ahmad Khan. 2019. "Valuation of Environmental Management Standard ISO 14001: Evidence from an Emerging Market" Journal of Risk and Financial Management 12, no. 1: 21. https://doi.org/10.3390/jrfm12010021